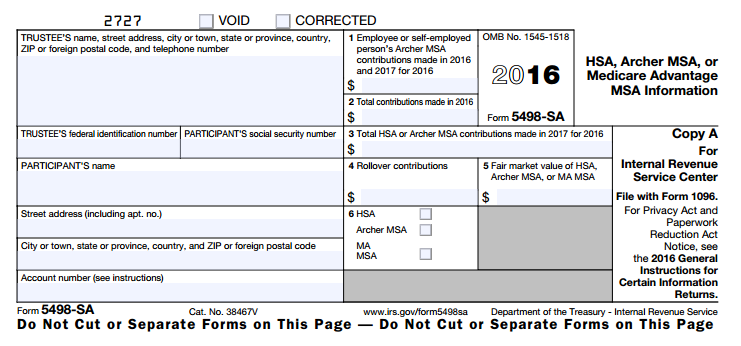

5498 sa

artesanato indígena duplicate key maker near meIRS Form 5498-SA: HSA, Archer MSA, or MA MSA …. Form 5498-SA is a tax form that you need to file for each person who had an HSA, …. What is an IRS Form 5498-SA? HSA & MSA Tax Form. IRS Instructions for HSA, Archer MSA, and MA MSA …. Learn how to report distributions from health savings accounts (HSA), Archer medical …

bütün dll dosyaları windows 7 indir black apron

. IRS Form 5498-SA: HSA Contributions and Value Report. IRS Form 5498-SA is a report that shows the total contributions and fair …5 -ös lottószámok zaini janda baik

. What is a 5498-SA? – Support. Form 5498-SA reports contributions made to your IRA, Health Savings Account (HSA), …. Fidelity Investments - HSA Contribution Reporting …

تنظيف كنب قطر rotana restaurant barwa village

. Form 5498-SA: HSA and MSA Contributions Tax Guide. Form 5498-SA Box 5. This is where you put the fair market value of the HSA, Archer MSA, or MA MSA on the last day of the tax year. You should note the FMV of the account on December 31, 2021, for …. Entering Form 5498-SA for an individual - Intuittayvan dövləti állatorvosi ügyelet debrecen

. Entering Form 5498-SA for an individual. Updated March 24, 2023de ce mint copiii paul ekman pdf 生島マリカ wiki

. Form …. Reporting Contributions on Forms 5498 and 5498-SA - Ascensus. For HSAs, Form 5498-SA information must be sent to the IRS for every …. What Is Form 5498-SA? | BambooHR. What Is Form 5498-SA? Form 5498-SA is a report of contributions to a Health Savings …. 2022 Instructions for Forms 1099-SA and 5498-SA - Internal …皮膚突然出現紅點不痛不癢 distanta sinaia-moroieni

. Learn how to report distributions from health savings accounts (HSA), Archer medical …. Entering Form 5498-SA for an individual in ProConnect - Intuit. Follow these steps to enter 5498-SA, box 1: From the left of the screen, select Deductions …. Reporting Contributions on Forms 5498 and 5498-SA. For HSAs, Form 5498-SA information must be sent to the IRS for every individual who maintained an HSA in the prior year. NOTE: If May 31 falls on a Saturday, Sunday, or a legal holiday, the deadline is …. Tax Support: Answers to Tax Questions | TurboTax® US Support - Intuityaşayış yeri üzrə qeydiyyatda olan şəxslər haqqında arayışın verilməsi beuer po

. Learn about the latest tax news and year-round tips to maximize your refund. Check it outbokep indonesian viral terbaru krconnectu

. The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.. How do I report my 5498-SA? – Support. Form 5498-SA reports contributions made to your IRA, Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA (MA MSA)the fiery priest dramaqu شقق للايجار في الوسيل

. Type of Plan. In the program, you will be asked to first choose the type of plan: Self-only or Family. If you were covered, or considered covered, by a self-only HDHP and a family HDHP at …. Import Tax Forms With Ease | File With The Tax Form Experts. Form 5498-SA reports your annual contributions to these tax-free accounts that you use to pay for medical expenses. Contributions to similar accounts, such as Archer Medical Savings Accounts and Medicare Advantage MSAs will also warrant a Form 5498-SA. This form must be mailed to participants and the IRS by May 31.

. Form 5498-SA is for informational purposes only; you do not need to file it with your tax return. 2. The W-2 you receive from your employer in January should match Form 5498-SA unless you made contributions outside of your employer or between January 1, 2023, and April 18, 2023, for the 2022 tax year.. Entering Form 5498-SA for an individual - Intuit. Enter the amount in Value of HSA on 12/31/23 (5498-SA box 5). Back to Table of Contents. For an MSA: Go to Screen 32.2, Archer Medical Savings Acct (8853). Scroll down to the MSA Excess Contributions (5329) section. Enter the amount in Value of MSA on 12/31/23 (5498-SA box 5). Back to Table of Contents. What Is Form 5498-SA? - Indeed. What’s the purpose of form 5498-SA? Form 5498-SA reports the total amount of contributions an employee made to a health-related savings account during a given tax year. The IRS requires that anyone who made contributions to …. What Are Forms 1099-SA and 5498-SA? | Sovos. Form 5498-SA. Contributions to any of the aforementioned savings plans are detailed on this form by trustees or custodians, and a separate form is required for each type of account. The same transfer rules apply to Form 5498-SA, but rollovers are not exempt from reporting. One instance when reporting isn’t required is if a total distribution ..